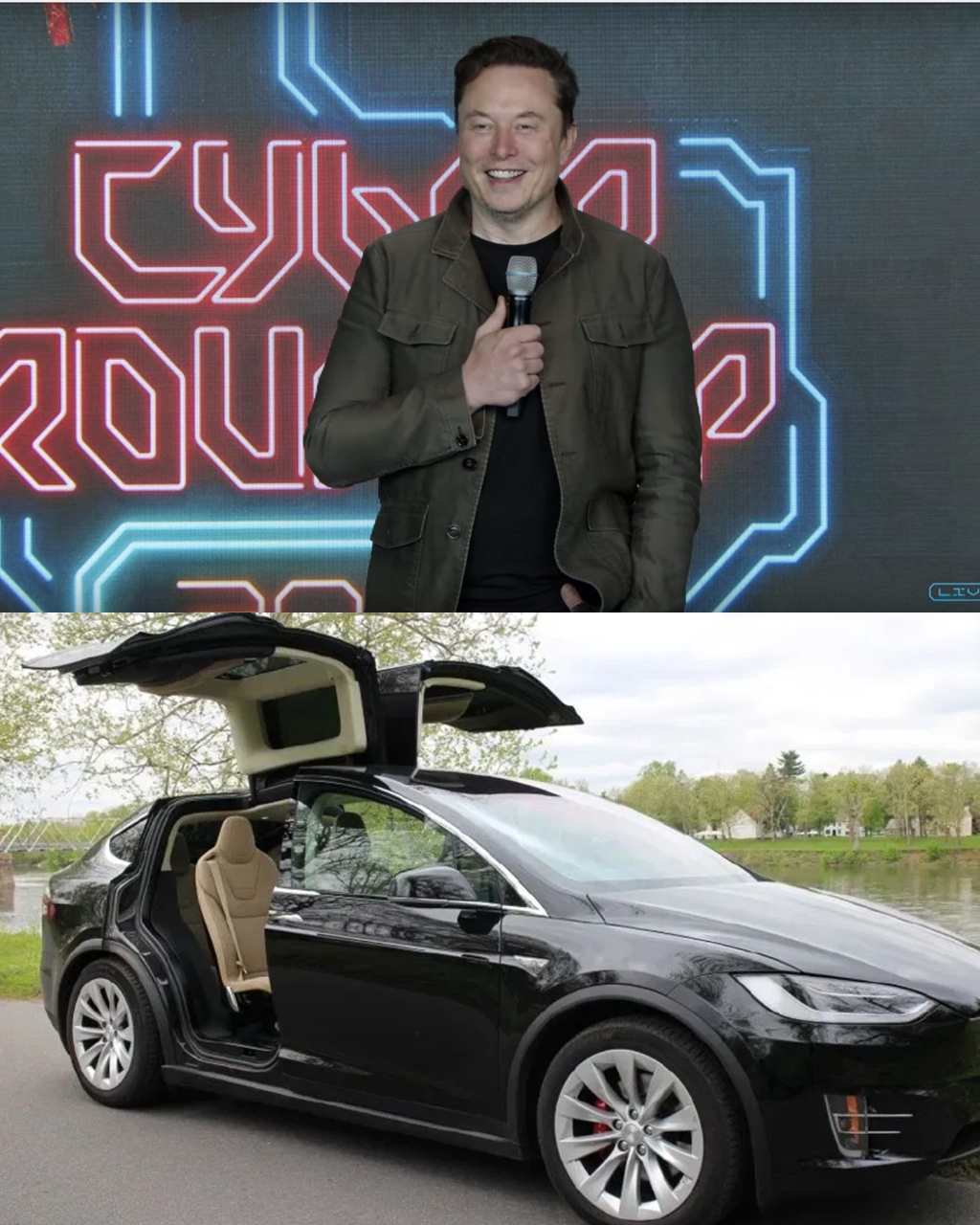

Tesla has published a video highlighting Elon Musk’s new CEO Performance Award, which is expected to take the company all the way to a market cap of $8.5 trillion.

Musk’s pay package will be voted on by Tesla shareholders at the company’s upcoming annual meeting of stockholders this coming November 6.

Tesla’s proposal

In its post, Tesla noted that the company pays for outstanding performance, not promises. Tesla noted that Musk’s previous pay plan, which has been fully accomplished, was intended to deliver billions to TSLA shareholders. This time around, the company is looking to deliver trillions to stockholders.

“We pay for outstanding performance – not for promises. In 2018, shareholders approved a groundbreaking CEO Performance Award that delivered extraordinary value. At our Annual Meeting on November 6, Tesla shareholders can vote on a pay-for-performance plan designed to drive our next era of transformational growth and value creation. Seven years ago, Elon Musk had to deliver billions to shareholders – now it’s trillions.

“This plan creates a path for Elon to secure voting rights and will retain him as a leader of the company for many years to come. But as explained below, Elon only receives voting rights after he has delivered economic value to you. Your vote matters. Vote ‘FOR’ Proposal 4!” Tesla wrote in its post on X.

Ambitious targets

The package calls for Elon Musk to grow Tesla’s market capitalization from its current $1.1 trillion to $8.5 trillion within the next decade. At that size, Tesla would surpass every other public company in history. For context, Nvidia, today’s most valuable company, is worth about $4.4 trillion, while Microsoft and Apple follow at $3.8 trillion and $3.7 trillion, respectively. Even Saudi Aramco, long among the world’s giants, holds a valuation of just $1.6 trillion.

To hit the $8.5 trillion target, Tesla must more than practically double Nvidia’s present value and expand nearly eightfold from its current scale. The plan also requires operating profit to soar from $17 billion in 2024 to $400 billion annually, while meeting ambitious product milestones: 20 million cumulative vehicle deliveries, 10 million active FSD subscriptions, 1 million Tesla Bots, and 1 million Robotaxis.

If achieved, Musk’s stake in TSLA would rise to 25%, with compensation topping $900 billion in Tesla stock. In a post on X, Musk explained that his priority with is new compensation plan is not about gathering wealth, it was about securing influence. “If I can just get kicked out in the future by activist shareholder advisory firms who don’t even own Tesla shares themselves, I’m not comfortable with that future,” Musk wrote in a post on X.

News

“WE DID EVERYTHING WE COULD” — LITTLE BOY DI-ES AFTER BEING PULLED UNCONSCIOUS FROM BOBS FARM POOL, COMMUNITY LEFT SHATTERED

A four-year-old boy has died after being pulled unconscious from a pool in a popular coastal holiday area of NSW. Credit: Google…

“THANK YOU… AND GOODBYE…” — MAGDA SZUBANSKI’S HOSPITAL WORDS STOP AUSTRALIA IN ITS TRACKS

Australia is holding its breath tonight. In a country that grew up laughing with her, quoting her lines, and seeing…

“SHE NEVER SAW THIS COMING” — Gina Rinehart’s $10 Million Invitation to Rihanna Sparks Global Tears and Hope for Australia’s Most Forgotten Children

When Australia’s richest woman makes a move, the world usually expects power, politics, or profit. This time, Gina Rinehart did…

“WHY WON’T THEY RELEASE THE FOOTAGE?” — DJ Warras Mur-der Sparks National Outcry as South Africans Demand CCTV Truth

When news broke that Victor Majola — widely labelled online as the “killer” of beloved DJ Warras — had sent…

“TIME IS WORKING AGAINST US” — Police Issue Grim Update in Hu:nt for Missing Family as Victoria’s Bushfire Crisis Deepens

A family-of-three is missing and more than 20 homes are potentially lost as out-of-control bushfires continue to burn across Victoria….

“I DIDN’T KNOW IF THEY WERE ALIVE” — Chi:lling Twist as Witness Reveals What He Saw Before Saving Two Toddlers in Banya Crash

Two toddlers, aged one and three, remain in critical condition at Queensland Children’s Hospital after suffering significant head injuries in…

End of content

No more pages to load