Elon Musk, once hailed as the invincible titan of innovation, is now navigating the most perilous chapter of his career. With Tesla bleeding over $800 billion in market value and his social media venture X (formerly Twitter) shedding an estimated $44 billion, the walls appear to be closing in. And as if the financial hemorrhaging weren’t enough, a series of escalating legal battles could alter the trajectory of Musk’s empire—and possibly the future of Big Tech itself.

Tesla’s Titanic Collapse: $800 Billion Gone

Once the crown jewel of Musk’s portfolio, Tesla has seen its market capitalization fall from over $1.2 trillion to under $400 billion. Investor confidence is shaken amid growing concerns over slowing EV demand, intensifying global competition—especially from Chinese automakers—and an increasing sense that Tesla may have lost its innovative edge.

Insiders say Musk’s focus has been too scattered, with critics pointing to his heavy involvement with X and other ventures as distractions from Tesla’s core mission. Shareholders are growing restless, and calls for leadership restructuring are gaining traction.

“We didn’t invest in Tesla to fund a social media circus,” said one major institutional investor.

X Marks the Misstep: A $44 Billion Hole

The acquisition of Twitter—rebranded as X—was supposed to be Musk’s bold step into the world of digital free speech and “everything app” ambitions. But instead, it’s turned into a financial sinkhole. Advertisers fled amid controversial platform decisions, chaotic policy shifts, and rising concerns about content moderation (or lack thereof).

With revenue plummeting and daily users declining, the platform is now valued at less than 25% of what Musk paid for it. The media has labeled it a “vanity project gone rogue,” and some analysts warn that X could be headed for insolvency unless drastic changes are made.

Legal Storm Brewing

As the financial toll mounts, Musk is now entangled in multiple legal challenges. Regulatory bodies in the U.S. and abroad are scrutinizing:

Tesla’s alleged misleading of investors regarding production targets and AI capabilities

Workplace discrimination lawsuits from former employees

Potential SEC action over statements Musk has made regarding X’s financials and his personal investments

There’s also speculation that activist investors could launch lawsuits demanding Musk step down or reduce his role in key companies.

Musk’s Response: Defiant, Yet Vague

Musk has responded in typical Musk fashion—defiant, tweeting memes, and dismissing critics. But even his loyal followers admit the tone has changed. Gone is the confident, calculating disruptor; in his place is a figure lashing out, seemingly cornered.

“This is the moment that will define Elon Musk’s legacy,” wrote a former SpaceX executive in a viral LinkedIn post. “Will he rise again or implode under the weight of his own ambition?”

The Bigger Question: What’s Next?

The situation raises urgent questions about the risks of centralizing so much power and vision in a single figure, especially in sectors as vital as energy, transportation, and digital infrastructure.

Is this a temporary stumble from which Musk will rebound stronger? Or are we witnessing the beginning of the end for one of the most iconic tech empires of the 21st century?

Whatever happens next, one thing is clear: Elon Musk is in the fight of his life—and this time, even Mars may be out of reach.

News

“My World Stopped That Day”: Grandmother’s Raw Heartbreak Revealed After Queensland Truck Cra:sh Claims the Lives of Her Daughter and Beloved Granddaughter

A grandmother is facing unimaginable heartbreak after losing both her daughter and granddaughter at the same time in a devastating…

“I L0st the Love of My Life”: Snoop Dogg’s Daughter Cori Broadus Reveals Devasta:ting L0ss of Her 10-Month-Old Baby Girl

Snoop Dogg and Cori Broadus; Cori Broadus holding her daughter.Credit : Christopher Polk/Billboard via Getty;Cori Broadus/Instagram Snoop Dogg’s daughter, Cori Broadus,…

NDIS Cutbacks, Silent Struggle, D-e-a-dly End: The Hidden Pressure Inside the Mosman Park Mur-der-Suici-de Trag:edy

A friend of the family that were found dead in an apparent murder-suicide in Mosman Park say the children’s National…

Second Note Discovered by Police After Family of Four Found D-e-a-d — Friends Reveal Hidden Truth Behind the Mur-der-Sui-cide, Claim “The Real K-i-l-ler Was Something Else”

A second letter was discovered inside the home of a family found dead in a suspected double murder-suicide in Perth. The…

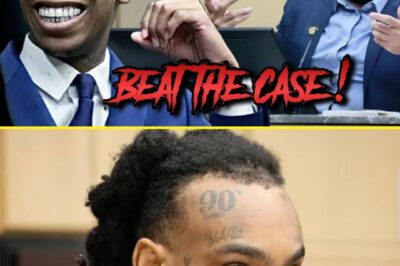

⚖️ Char:ges Vanish Overnight — YNW Melly Courtroom B0mbshell Leaves Fans Stunned as Legal Landscape Shifts Without Warning

The legal world — and the internet — is buzzing tonight after a shocking and unexpected courtroom twist involving YNW…

💔 “You See Who’s Really With You in the Dark” — Lil Durk’s Cryptic Ja-il Message Sparks Chaos as Fans Claim India Royale Has Moved On

Lil Durk is once again at the center of an emotional firestorm — and this time, it’s not about charts,…

End of content

No more pages to load