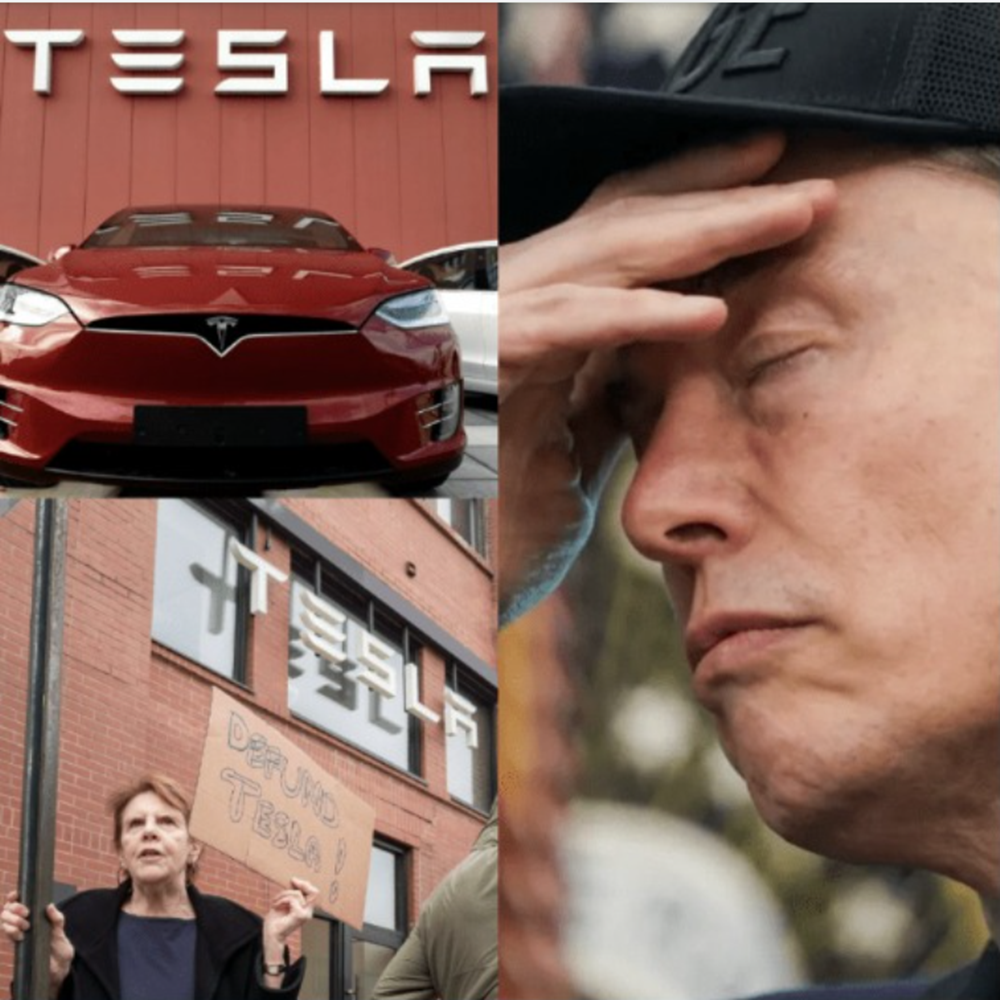

Tesla’s golden days of sky-high profits and investor praise may be fading faster than anyone expected.

As the electric vehicle giant struggles to maintain profitability amidst rising production costs, fierce competition from China, and stagnating demand in key markets, CEO Elon Musk is now facing increasing pressure from Tesla’s biggest investors — many of whom are demanding answers.

“The numbers don’t lie,” said one anonymous shareholder.

“We’ve trusted Elon for years. But now we want results, not promises.”

📊 Profitability Crisis: What’s Going Wrong?

Tesla’s latest quarterly earnings report showed a 17% drop in net income, marking the third consecutive quarter of declining profits. While revenue remains strong, margins — once Tesla’s biggest financial bragging point — are slipping rapidly.

Several factors are to blame:

Price cuts across popular models like the Model 3 and Y to stay competitive

Soaring costs of lithium and rare-earth materials

Increased spending on new Gigafactories and AI ventures

A slowing EV market in Europe and the US

Worse still, competitors like BYD, Rivian, and even legacy automakers like Ford and Volkswagen are clawing away at Tesla’s global market share.

🔥 Musk in the Hot Seat

During the last shareholder meeting, Musk appeared uncharacteristically defensive, acknowledging the financial “bumps” but urging investors to “trust the long game.”

“We’re building the future. That takes time and sacrifice,” Musk said.

“Profitability will come — just not the way Wall Street is used to.”

But that long game may be wearing thin for some. Tesla’s stock is down nearly 40% from its 2021 peak, and murmurs of frustration are getting louder.

One institutional investor told Reuters:

“If Tesla doesn’t show profit stability by the next quarter, there will be a serious push for board restructuring — maybe even a new CEO discussion.”

🤖 Too Many Bets?

Some analysts believe Musk’s growing list of side projects is partly to blame:

xAI, his new artificial intelligence company

Neuralink and its controversial human trials

Twitter/X, which continues to drain both money and attention

Mars colonization plans with SpaceX

“Tesla is still a brilliant company,” said tech analyst Kara Vance.

“But it feels like Musk is playing 4D chess on five boards at once — and Tesla’s the one being sacrificed.”

🔮 What’s Next?

Tesla has already hinted at a next-gen, ultra-affordable EV set to launch in late 2026, and its robotaxi program is expected to go live in pilot cities in 2025.

But neither of those innovations will boost profitability fast enough, according to investors.

Unless Tesla shows a clear, focused path back to profit, pressure from shareholders could reach a boiling point — and Musk may find himself fighting not just market trends, but his own boardroom.

✍️ Final Thought

Elon Musk has built an empire by betting big and defying expectations.

But this time, with Tesla’s future on the line and billions at stake, the world is watching closely — and waiting to see if even the world’s boldest visionary can keep his company, and his promises, alive.

News

Lil Jon Lays Son DJ Young Slade to Rest on First Day of Ramadan — Final Whisper at Graveside Leaves Everyone in Tears

In a deeply emotional farewell that shook fans and loved ones alike, rapper Lil Jon laid his only son, Nathan…

Gold Coast Crash H0rr0r: Mother Accused of K-i-lling Three-Year-Old Son Hints at “Something Went Wrong” in Sh0cking Custody Hearing

A young mother accused of killing her child in a car crash will remain behind bars after her lawyer did not apply…

Breaking: Chaos erupted on a busy Papakura road after gu-nsh0ts were fired — and officers say they actually heard the sh0ts themselves while out on patrol

Armed police at the scene in Auckland’s Papakura. (Source: 1News) A man has been injured following a shooting in the Auckland…

Bl00dshed in the Bush: Fatal Fight at Remote NSW Campsite Sparks Urgent Hunt for Fugitive

A man is dead and another has been arrested following a deadly campsite scuffle in NSW. Police received reports of…

It Happened So Fast: Midday Horror at Beecroft Peninsula as Fisherman Loses Footing and Disappears Beneath the Waves — Hours Later, Grim Outcome Confirmed Off the NSW South Coast in a Twist That’s Shaken the Local Community

A body has been recovered after a fisherman slipped into the water on the NSW South Coast. The man, believed to be…

Trapped in Paradise? MAFS Star Shares Spine-Chi:lling Midnight Video From Dubai High-Rise — Whispers, Sudden Darkness and a Moment She Didn’t Notice Until Rewatching Leave Fans Convinced Something Sinister Was Happening Behind the Scenes

Mikey Pembroke has shared terrifying footage as air strikes rain down on his Dubai apartment. The Sydney-based former reality star, who…

End of content

No more pages to load